$250.00

Description

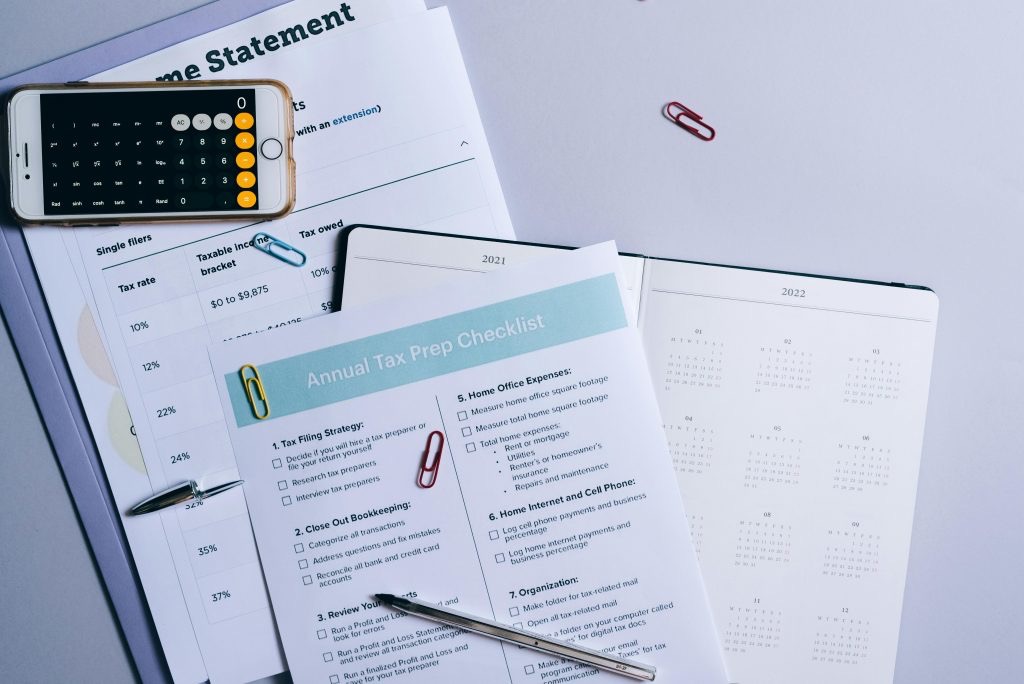

I’m writing to let you know about our retainer for preparing your 2024 individual income tax returns. We’ll take care of everything from preparing and electronically filing your tax returns with the Internal Revenue Service (IRS) and the state tax authority, to sending you your copy electronically.

Your invoice will be based on the time we spend and the forms we need to prepare your tax returns. The retainer will be deducted from the invoice.

If you’d like to pay by credit card other than Apple Pay or Google Pay, just add the retainer to your cart and then proceed to checkout to provide your credit card information.

- What is the average charge for a CPA?Basic filings (Form 1040): $200–$400.

Itemized deductions: $300–$700.

Small business income or rental properties: $800–$1,500: - Is it worth hiring a CPA?According to the American Institute of CPAs, no less than 150 semester hours of education, which includes a concentration in accounting classes, is required to sit for CPA certification. While a master’s degree is not required to obtain certification, there are different routes to accomplish this educational requirement. One route includes obtaining both an undergraduate and master’s degrees in accounting. Another option is to obtain a master’s degree in accounting or an MBA with an accounting focus if their undergraduate degree was not in accounting. A third option includes enrolling in a five-year program that grants a student a master’s degree in accounting. It is known that each state and federal territory has individual requirements for CPA certification.